This is part two of our series, Start an LLC with Me. In this series we're walking you through each step to setting up an LLC and becoming a fully operational small business. Read part one here.

If you recall from our first post of the series, my friend and I started a small business that began to make money. My accountant advised us to form an LLC for tax purposes. We officially formed an LLC with The Incorporators and received all the documentation we need to move forward with setting up other elements of our business.

Applying for an employer identification number, commonly known as an EIN, is probably the first thing you want to do after your LLC is officially formed. It is a fairly simple process that takes only a few minutes.

Today we're walking you through the process so you'll know exactly what to expect when you're ready to apply.

What is an EIN?

First things first, what is an EIN? An EIN is an Employer Identification Number. It is given to businesses by the IRS and essentially serves as the social security number for the business as a whole.

EINs are commonly referred to as EIN numbers, despite the fact that the "N" in the acronym stands for "number".

EIN Application - A Step-by-Step Guide

You can begin the EIN application process on the IRS website here. Please note that applications are accepted from 7am to 10pm EST. The portal to apply is closed outside of these hours.

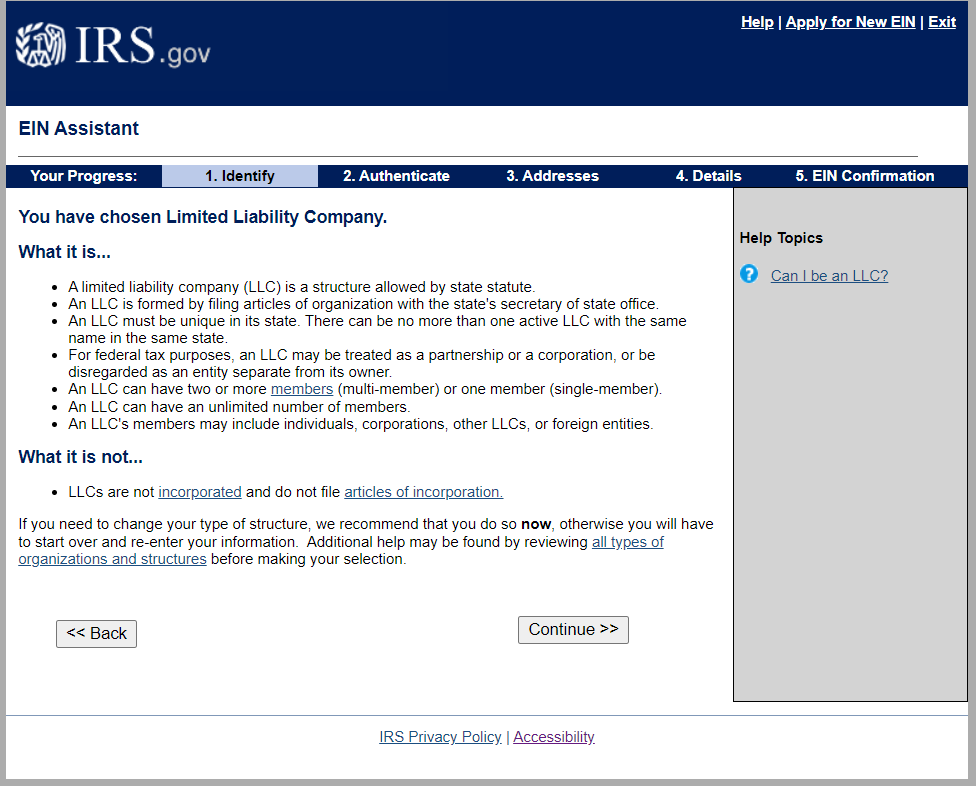

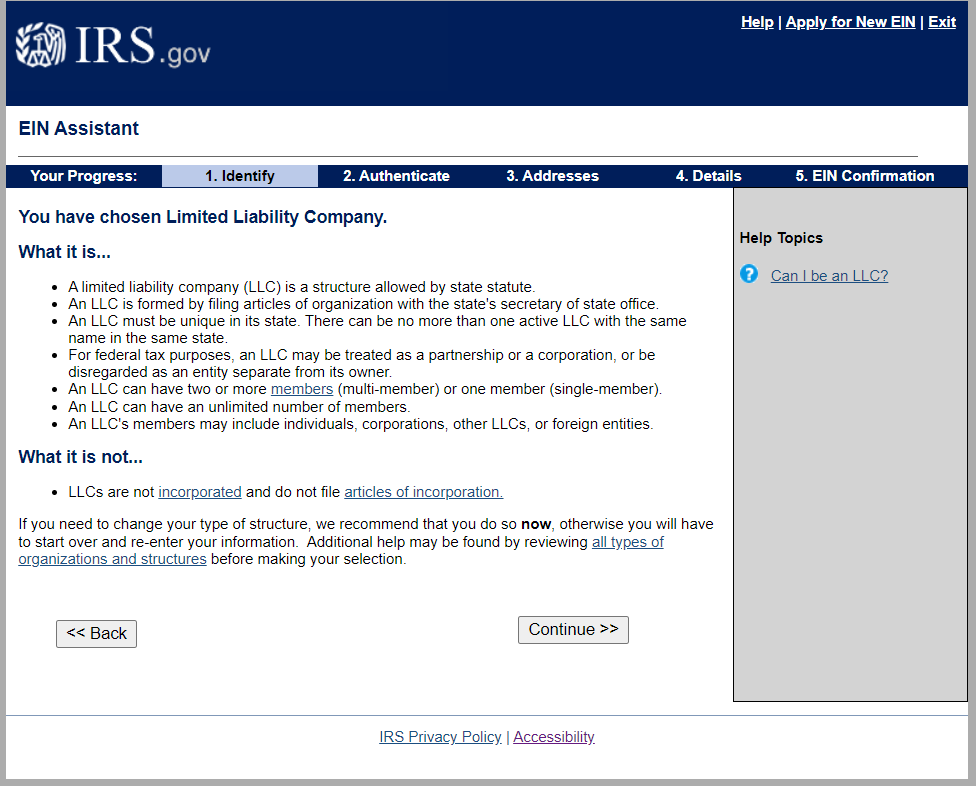

So far so good. The next page will refresh your memory about what an LLC actually is (just to make sure you really have one).

Click continue and move on.

For my own LLC, my partner and I are both members (owners) so we have a multi-member LLC and have input 2 here. If you are the single owner of the LLC, you'll put a 1 here.

One thing to note, the second question is asking where your business is physically located, not where your LLC was formed.

This was the first question that tripped me up a bit. Should I put Delaware, where my LLC is based and where my registered agent (The Incorporators) is? Or do I choose Pennsylvania, where I reside and where my business is physically located? In this field you want to input the state where you reside or where your business is physically located. There are questions further in the application process that address where the LLC was formed.

Moving on to why you're requesting an EIN.

This is fairly self-explanatory.

Of note, it will only ask for the social security number of one member. At no point during the process did I have to provide my partner's social security information, despite the fact that we each own 50% of the company.

This is the page I noted earlier, where you will provide the information about the state where your business is located, plus the state where it was formed.

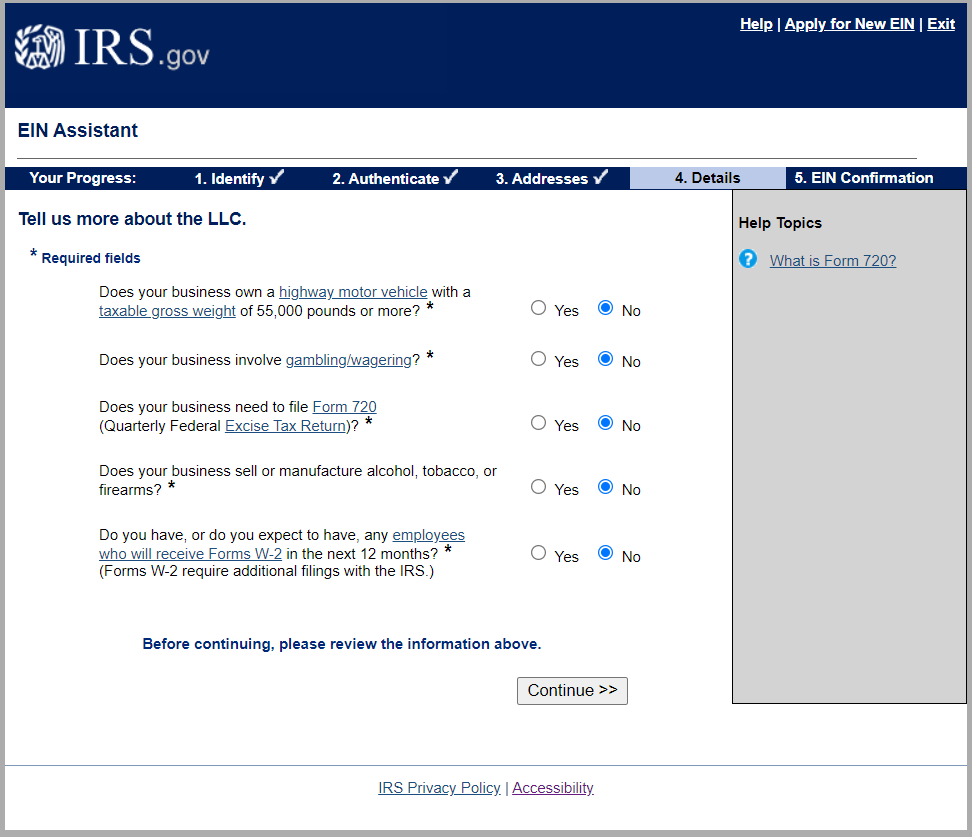

Next you'll answer a few yes or no questions about your LLC.

The next few steps contain basic information about what your company does, which you will select from the lists provided. Depending upon what you select, there may be a few pages here as it narrows down your business focus with additional checkbox options. I struggled to decide where our business fit in to these categories but chose what I felt was most appropriate.

As you can see, the first set of options is fairly easy but once I selected one, it narrowed down more.

For businesses in more traditional sectors, this part may be fairly easy. If your business is internet based or is non-traditional, you may find the categories challenging. I selected those that were closest to what our business is but they weren't a perfect match.

Once you're done this section, you'll review all the details you've submitted.

Once you click "Submit" you will automatically receive your EIN.

Make sure you download and save your EIN Confirmation Letter from the link shown. I saved ours to my computer, our shared drive, emailed it to myself, and printed it and filed it with our formation paperwork.

And that's it! Now that we have the EIN number, we are able to proceed with the next step in starting our business - applying for a business bank account.

We hope you found this helpful and we look forward to walking you through the business bank account details and options in the next post in this series.