Ensuring compliance with financial regulations is crucial for businesses to uphold integrity and security in their operations. The Corporate Transparency Act mandates that many businesses file beneficial ownership information reports with FinCEN, the Financial Crimes Enforcement Network, a bureau of the U.S. Department of Treasury. To learn more about the CTA and what it means for many business owners, take a look at our CTA FAQs page.

The Incorporators has partnered with FinCEN Report, a third-party service that walks you through the process of filing your BOI report. Think of it like utilizing an online software to file your taxes. Sure, you can file your taxes directly with the government, but having your hand held a bit for complex legal requirements is sometimes worth paying for.

Today we'll break down the steps to file your BOI report seamlessly, empowering you to fulfill your reporting obligations with confidence. Let's walk through the process of filing your BOI report with FinCEN Reports so that you can simplify your reporting procedures and ensure compliance with the Corporate Transparency Act.

Filing Your BOI Report with FinCEN

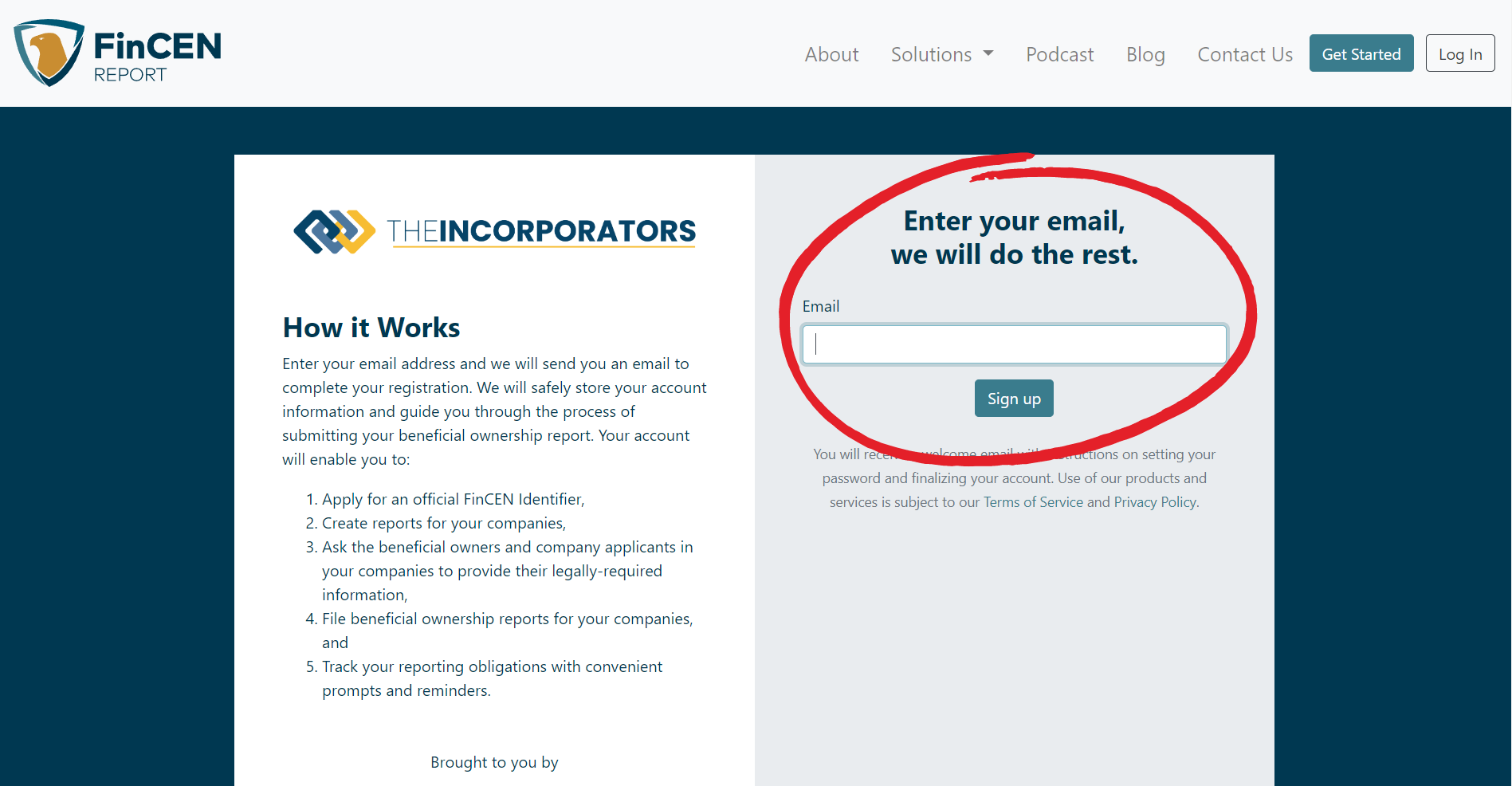

Step 1: Enter Your Email

Getting started is easy! Just start here and enter your email on the FinCEN site and you'll be sent an email to confirm your account setup.

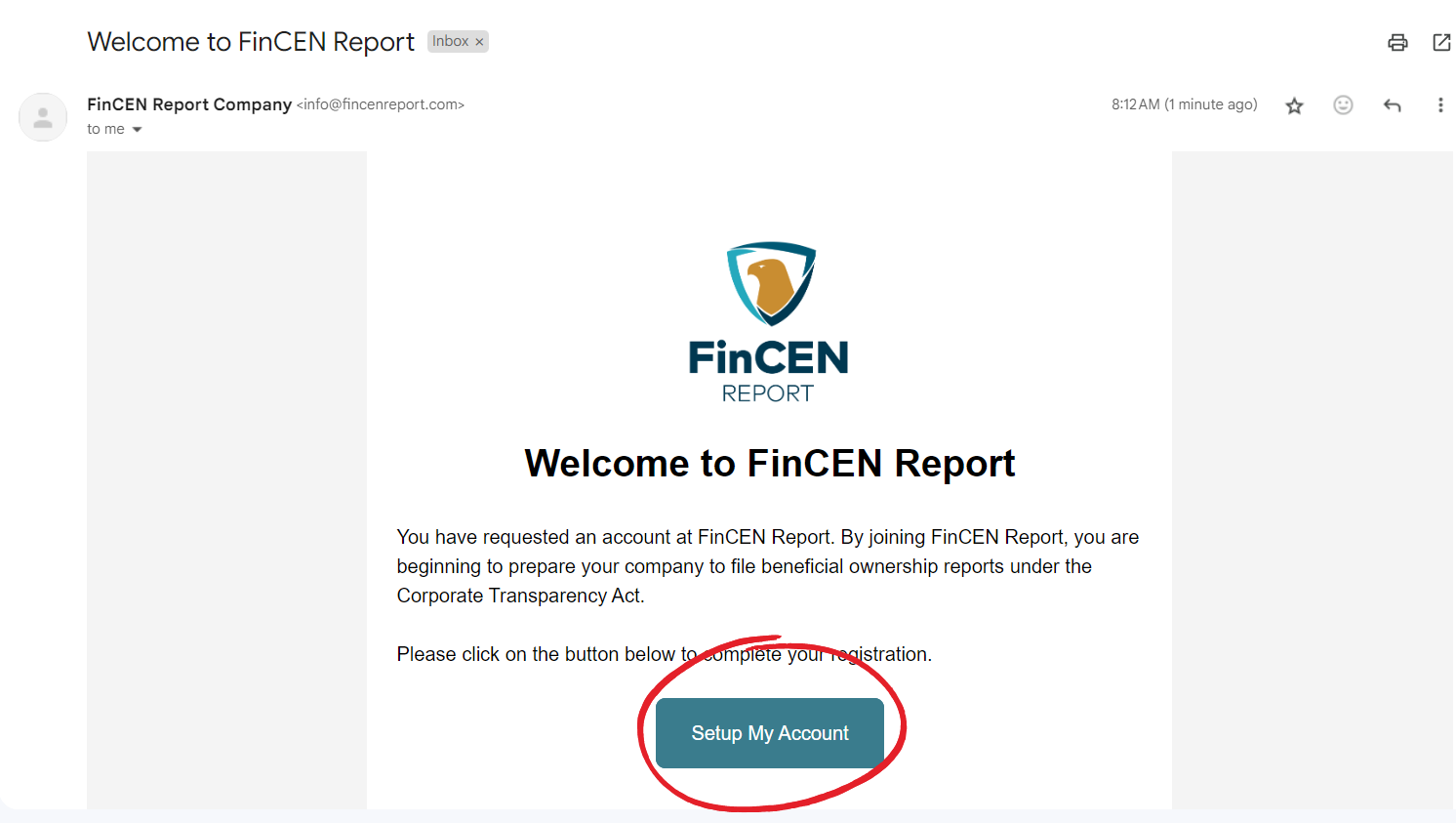

Step 2: Setup Your Account

The email you receive will look like this. Click "Setup My Account" to proceed.

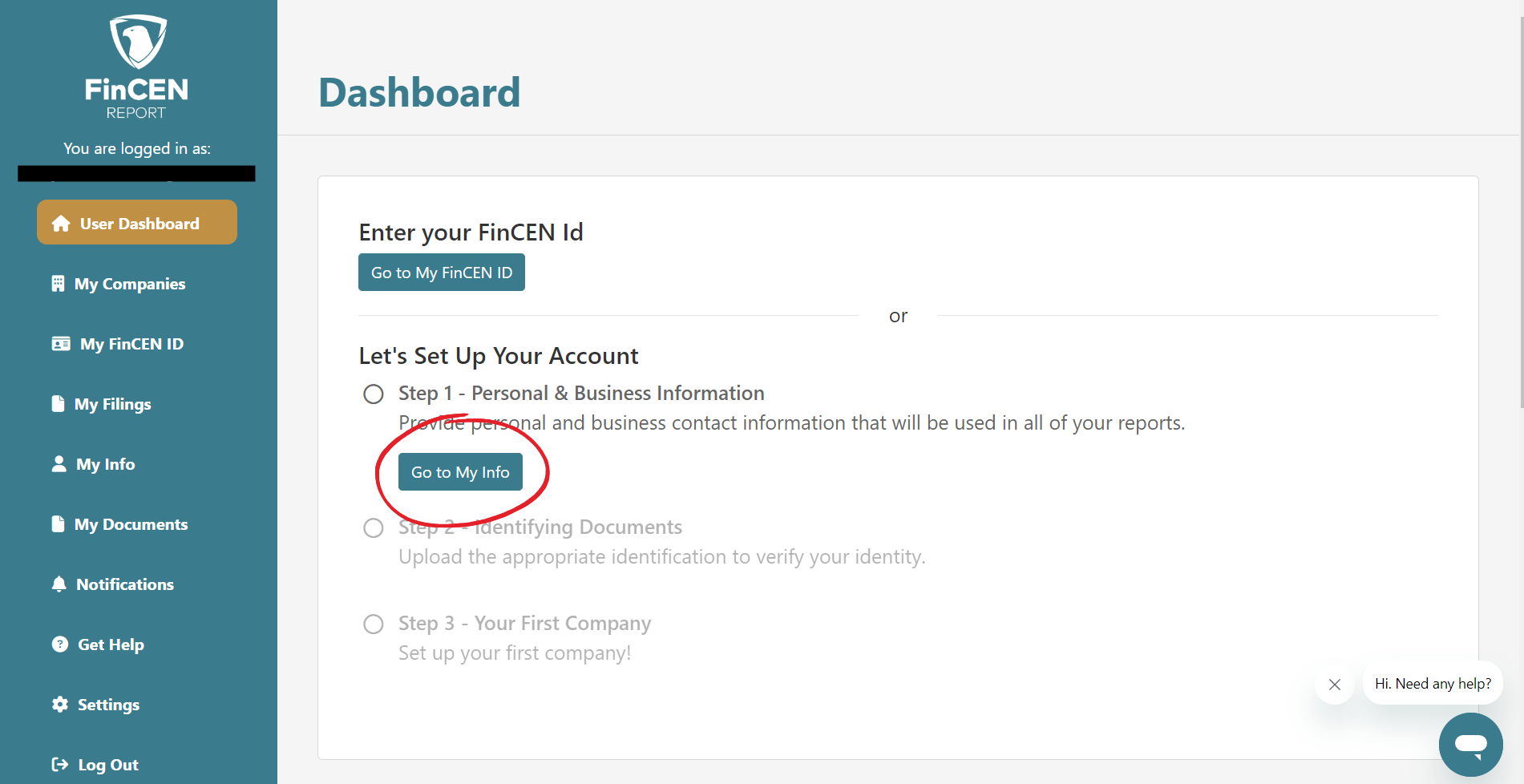

Step 3: Intro to Dashboard

Once you've created an account, you'll be given access to your dashboard. You'll see that the navigation menu is on the left side and is straightforward and user-friendly.

Click on "Go to My Info" to get started entering your personal details that are required for the BOI report.

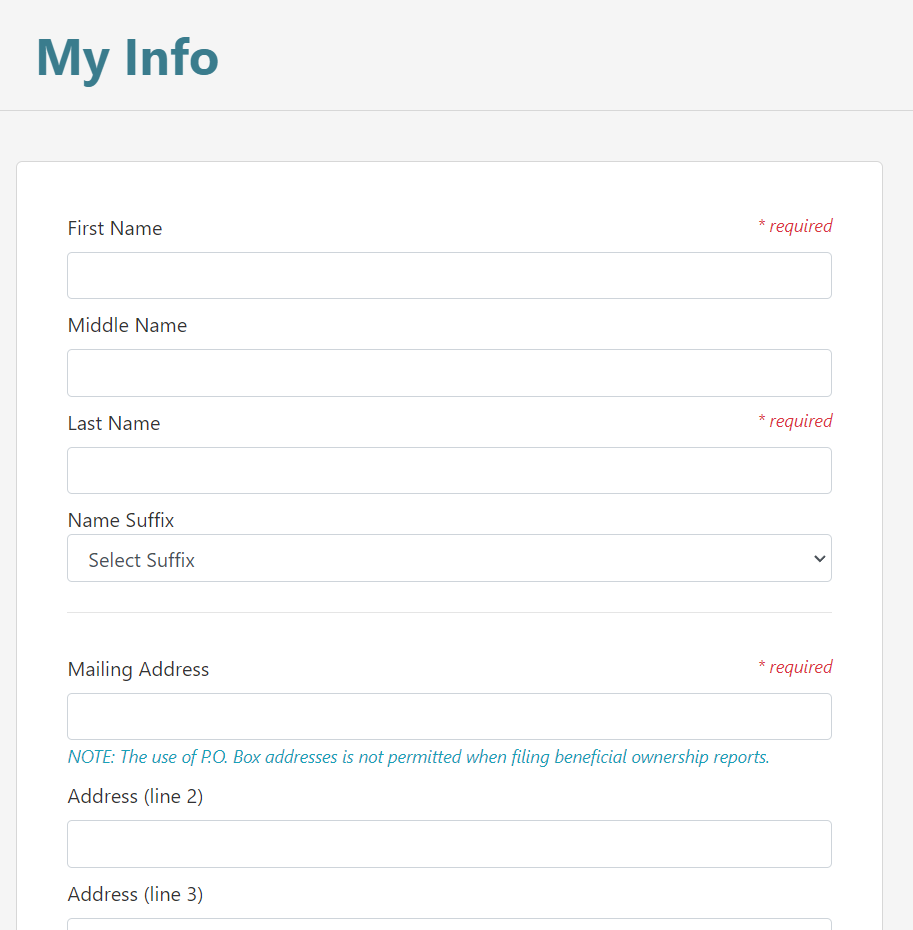

Step 4: Personal Details

You'll see that the personal details are very simple, just your name and contact information.

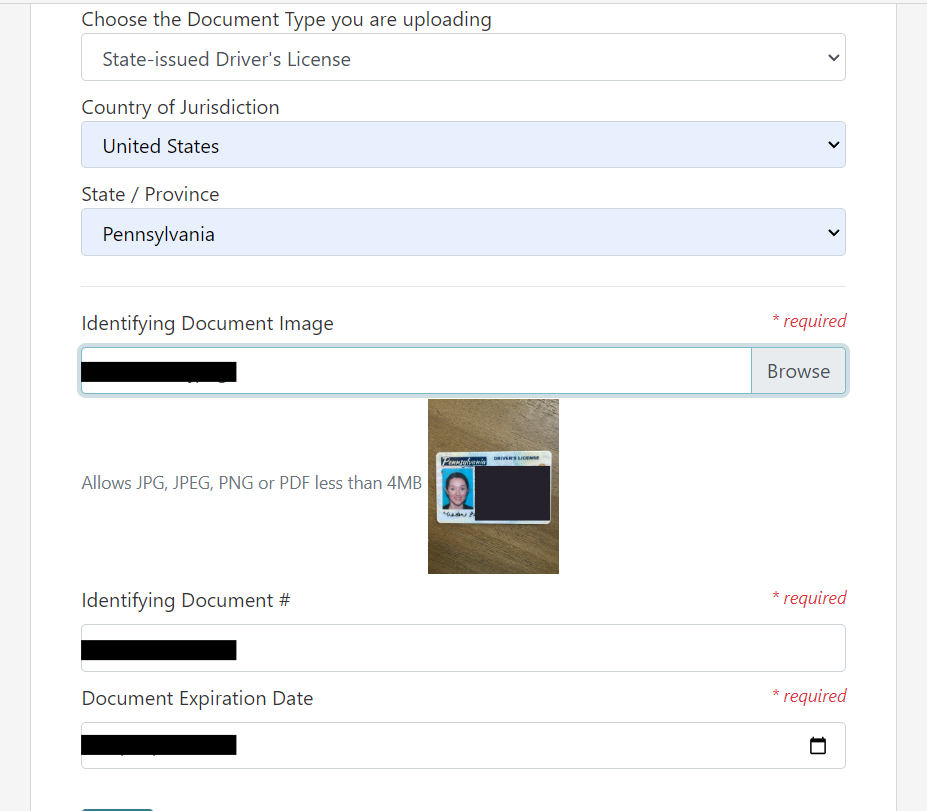

One of the requirements of the BOI report is that beneficial owners provide a valid form of ID. You are able to use several different types of documents for personal identification, including a drivers license or passport.

A simple camera phone photo of your identifying documents, taken in good lighting and with a steady hand, is all you need.

Step 5: Add Your Company

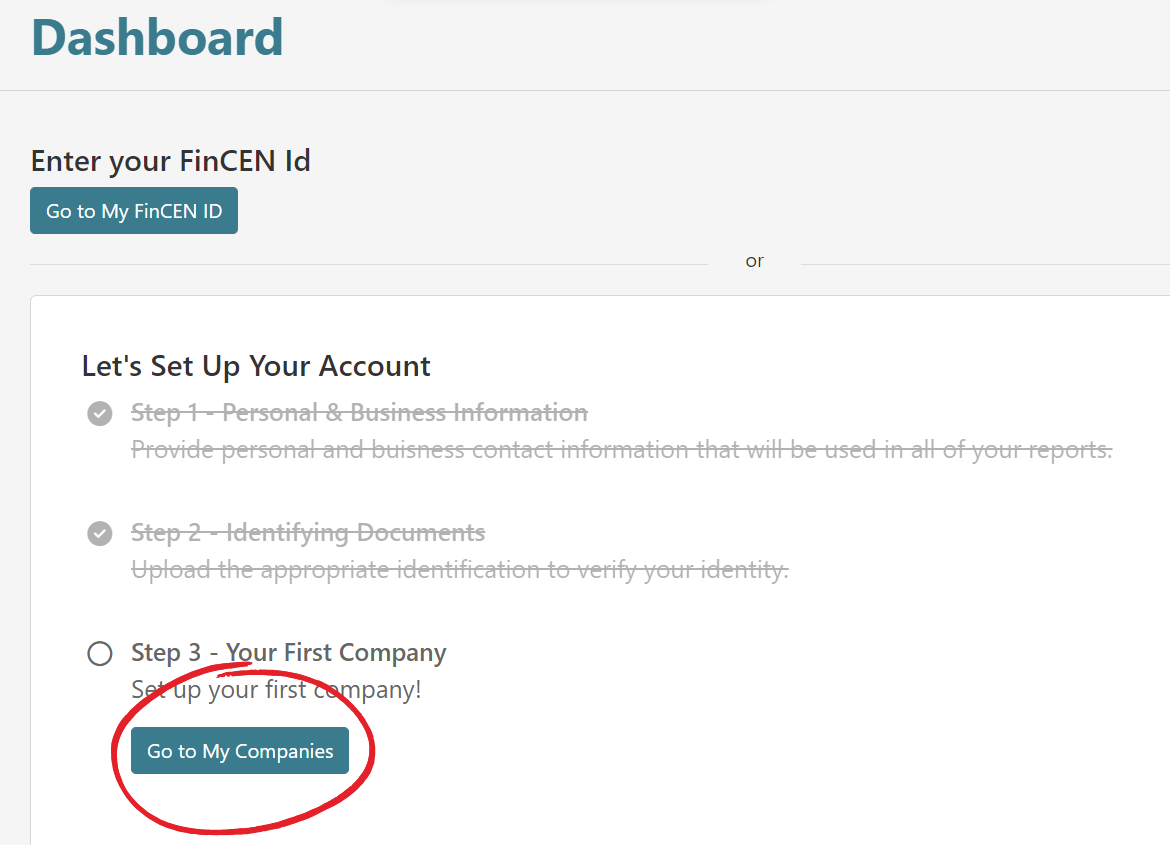

When you're done adding personal details, you'll be sent back to the dashboard and you will see a checklist. Proceed with adding your company details by clicking "Go to My Companies".

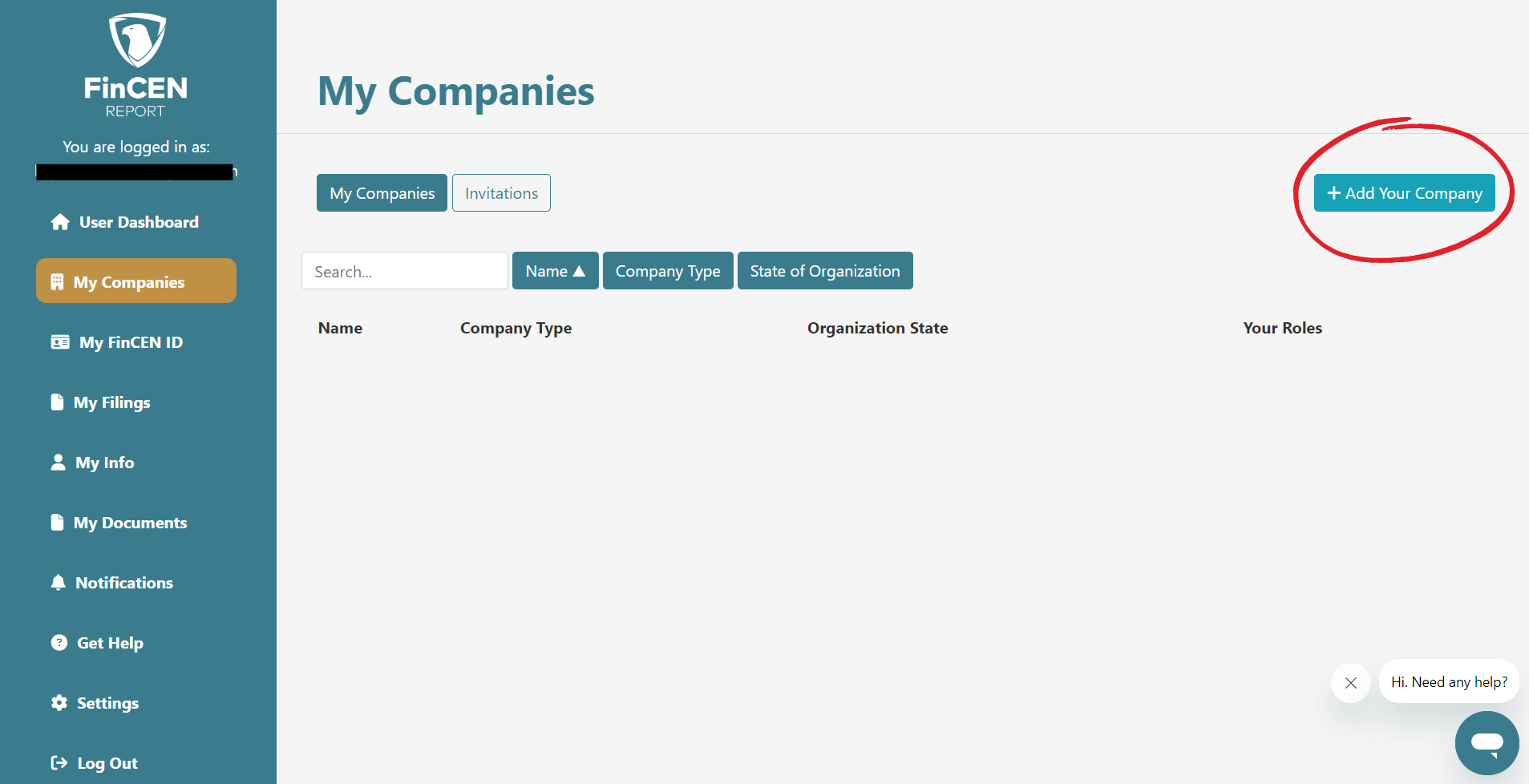

This will take you to the My Companies dashboard where you can begin the process of adding your entity.

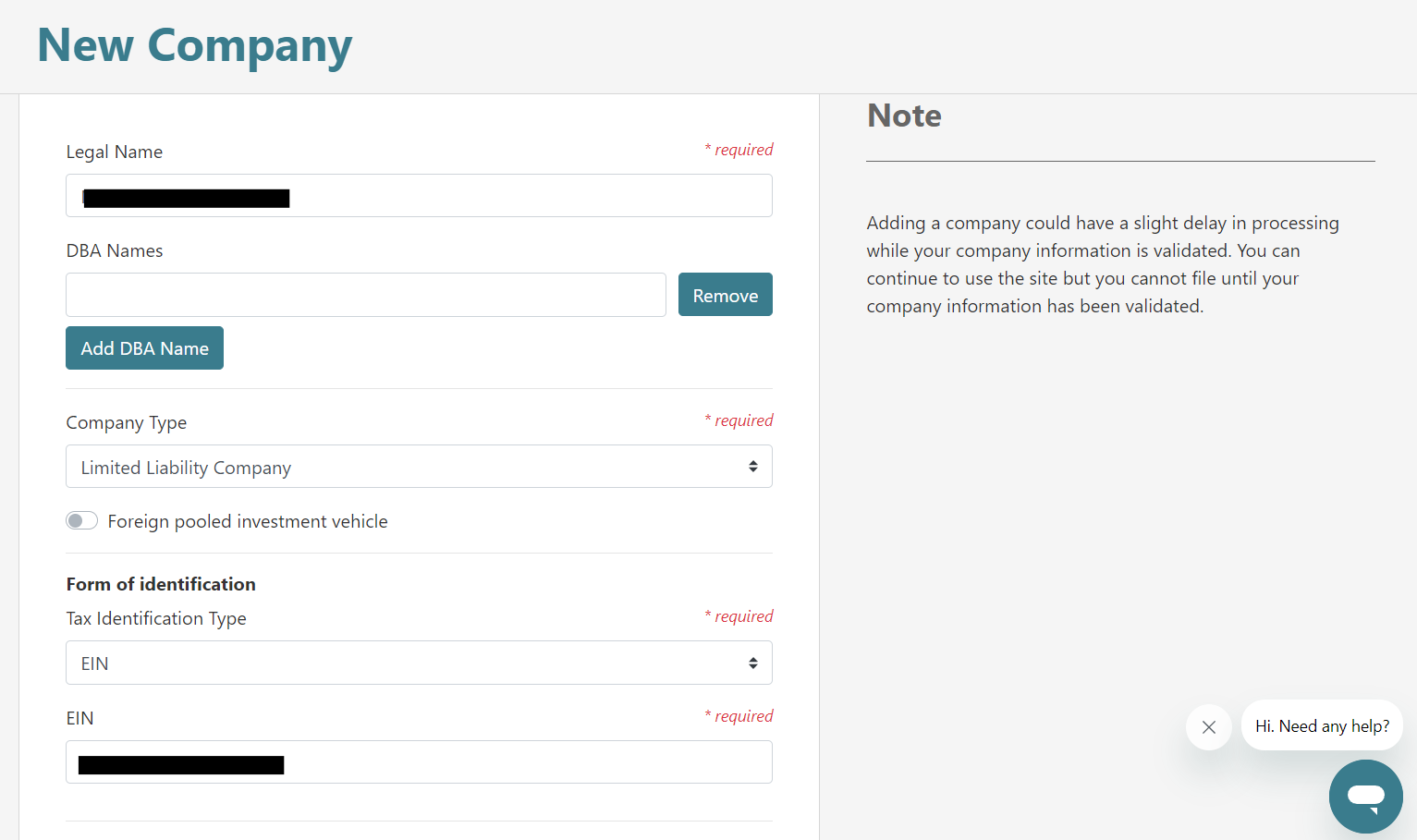

The company details are simple and you must include a form of identification for your entity, like an EIN.

Once your company details are added, you'll be taken back to the My Companies dashboard where you will see a brief summary of the company. If you had multiple entities, this is where you would see all of them listed.

Step 6: Begin the Filing Process

Once your company is added, click "My Filings" to be taken to the Filings page.

Once you click the entity name, you will be prompted to purchase a product from FinCEN reports.

Purchasing the product allows you to proceed with filing your BOI report though FinCEN Report. If the entity has a single owner, you can proceed with the Report EZ Single package at $29 or opt for the Report 365 package, which is a subscription service at $199 per year. Report 365 allows unlimited beneficial owner submissions and unlimited post-filing amendments. The Report EZ is a one time service.

If you are filing as a single member LLC, you can skip Step 7 and proceed to Step 8 below.

Step 7: Adding Additional Members (for Multi-Member LLCs)

For entities with multiple owners, you can opt to click the entity name and review the company details and add other members.

It's important that you do this before you purchase a product, as a multi-member LLC is not eligible to purchase the Report EZ Single package and must purchase the Report EZ Dual package at $99. This is because the process of collecting data from the additional members allows them to keep their documents (like drivers license) private and submit them separately.

Once you click "Add New Member" you'll see a pop-up to enter their email and member name, as well as their primary role.

The other member will then receive an email from FinCEN Report and may click the link to upload their personal information, just as you did in Step 4 above.

Once the additional member completes their portion and all information is finalized, you can proceed with purchasing a package from FinCEN report. As a multi-member LLC, your options are the Report EZ Dual or the Report 365 subscription.

You will be prompted to select your package and proceed to checkout via Stripe.

Step 8: Submit Your Report

Once you've purchased a package, your My Filings page will look like this:

Once you click "submit report", you will see a notice that your report is pending submission. There is nothing more for you to do but you may continue to log in to check the status.

Once FinCEN accepts your report, that same page will appear like this:

If you select "download", you will be able to download a PDF from FiNCEN with your BOI Report status noting "Filing Successful" as well as the submission tracking ID. Download this and save it for your records as proof that you submitted your BOI Report.

And that's it! Filing your BOI Report with FinCEN Report is easy and ensures that you are filing your report completely and correctly.

As a reminder, for the remainder of 2024, all new entities who are required to file a BOI Report must do so within 90 days of receiving their completed LLC formation or Incorporation documents. Entites that existed prior to 2024 have until the end of the calendar year to submit their BOI Report.

To get started, visit FinCEN Report today! If you have any questions related to BOI Report filing with FinCEN Report, give them a call at (845) 393-4623.